Introduction to Family Budgeting for Kids

Why Early Financial Education Matters

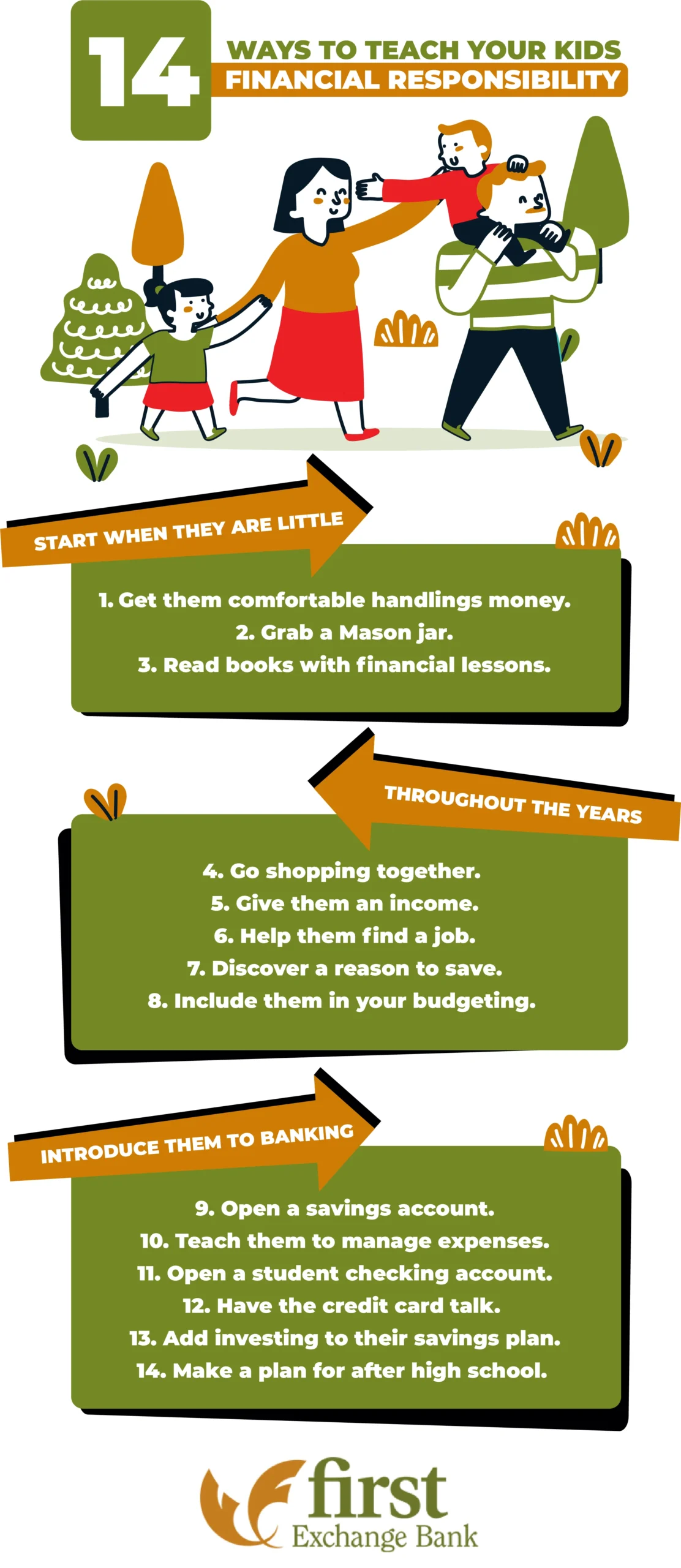

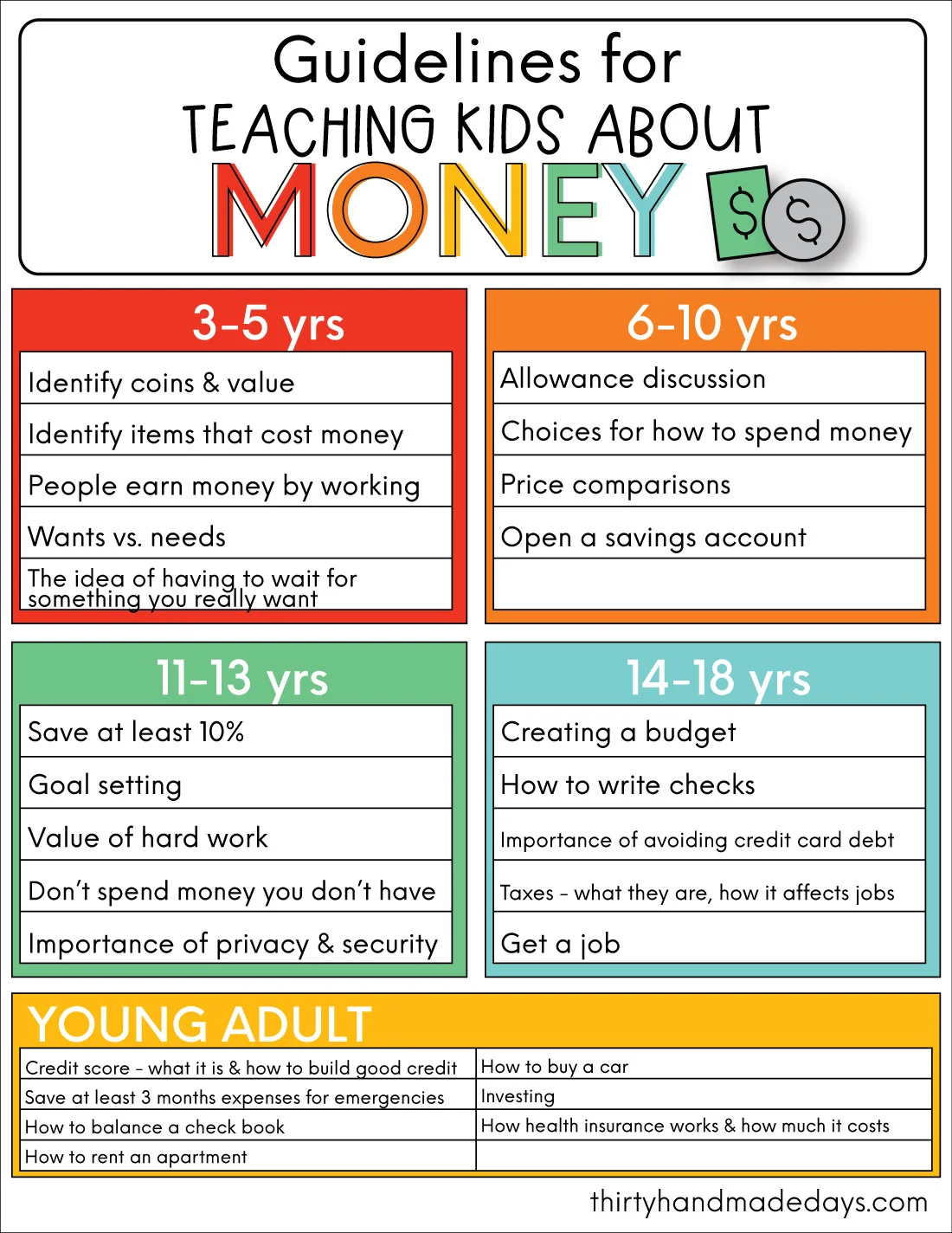

Imagine your child excitedly counting coins in a clear jar, watching their savings grow day by day. Early financial education has a profound impact on children’s future money management habits. Teaching kids about budgeting, saving, and spending helps them develop essential life skills that build confidence and independence. When financial lessons begin early, children are more likely to avoid common money mistakes and make informed decisions as adults. Parents who prioritize this education empower their children to understand money’s true value through everyday experiences rather than just abstract lessons.

The Role of Parents in Teaching Money Management

Parents are the primary role models in shaping their children’s understanding of finances. It’s not just about handing over an allowance but about involving kids in real family financial decisions. For example, sitting down together to plan a grocery run on a set budget or discussing why paying bills on time matters can turn everyday routines into teachable moments. By being transparent about money challenges and successes, parents create an environment where kids feel comfortable asking questions and experimenting with financial choices in a safe space.

Step 1: Assess Your Family’s Income and Expenses

Understanding Household Cash Flow

Before setting a family budget that includes your children, it’s crucial to understand your household’s income and cash flow. Think of it like planning a road trip; you need to know how much fuel you have before deciding the distance you can travel. A real-life example might be reviewing your paychecks, side incomes, and any irregular earnings alongside bills like rent, utilities, groceries, and education costs. Discussing this broad overview with older kids helps them grasp where money comes from and where it needs to go, making the abstract idea of budgeting more concrete.

Tracking Monthly Spending Patterns

Tracking spending can be an eye-opener for the whole family. One mother shared how her teens were amazed to see how much they spent on snacks and entertainment monthly when she showed them a simple chart. Using receipts, bank statements, or even apps to tally expenses encourages children to see patterns and identify areas where the family can save. This transparency lays the foundation for responsible budgeting, as kids understand that overspending in one category impacts other needs or wants.

Step 2: Involve Kids in Budget Planning

Age-Appropriate Financial Discussions

Involving kids in budget planning doesn’t mean discussing complex numbers from day one. For younger children, it could start with choosing between two snacks at the store to highlight cost differences. Older kids can participate in planning a family outing, balancing fun with the event’s cost. For instance, a parent once let their 10-year-old help decide between a movie night or a picnic based on the budget available. Tailoring discussions to age ensures kids remain engaged and do not feel overwhelmed.

Setting Family Savings Goals Together

Setting shared savings goals is a powerful motivator. The Johnson family decided they wanted to take a special vacation but needed to save extra. They involved their children in tracking the jar of coins and cash contributions, turning it into a family project. Each child had a small responsibility, like suggesting ways to save on groceries or earning extra money through chores. This collaborative effort teaches that collective planning and patience yield rewarding outcomes, helping kids link saving with real desires.

Step 3: Creating a Simple, Visual Budget

Using Charts and Apps to Teach Budgeting

Children often learn best when they can visualize concepts. Using charts that break down spending categories or simple budget apps designed for families can transform budgeting into an interactive and accessible task. For example, one parent replaced the traditional piggy bank with a clear jar so their kids could see how their savings grew, making abstract ideas tangible. Alternatively, apps that track allowances and spending encourage kids to take personal responsibility while offering a fun digital experience.

Allocating Money for Needs, Wants, and Savings

Teaching kids the difference between needs, wants, and savings is essential when creating a budget. A practical scenario is guiding children to divide their allowance into three parts: essentials like school supplies (needs), things they wish to buy like toys (wants), and money set aside for future goals (savings). One family made this process hands-on by labeling three jars for their kids and encouraging them to decide how much to put in each weekly. This habit cultivates thoughtful spending and a clear understanding of prioritization.

Step 4: Implementing Allowances and Spending Limits

Linking Allowances to Chores or Tasks

Giving allowance as a reward for completing chores teaches children that money is earned, not just given. A father shared how his daughter eagerly took on tasks like watering plants and organizing bookshelves because she knew it meant more money to save for her bike. This method helps kids connect effort with reward and understand the value of work. It also reduces entitlement and emphasizes responsibility, making financial lessons more memorable and practical.

Teaching Delayed Gratification and Prioritizing Expenses

Managing spending limits and delayed gratification often comes with practice and gentle guidance. For example, when a child wants an expensive toy, parents can encourage setting a savings goal rather than buying immediately. One mother described how her son saved part of his chore-earned allowance over several weeks to buy a video game. The joy he felt was amplified by having earned and waited patiently. These experiences instill crucial money habits, teaching kids to prioritize long-term benefits over impulsive purchases.

Step 5: Monitoring and Adjusting the Budget as a Family

Monthly Family Budget Reviews

Setting aside time monthly to review the family budget together turns financial management into a shared responsibility. During these discussions, the family can celebrate achievements like hitting a savings target or brainstorm solutions if expenses exceeded the plan. One family used these sessions to adjust their grocery budget after realizing they were overspending on convenience items, with the kids suggesting homemade alternatives. This ongoing dialogue keeps everyone accountable and teaches adaptability.

Encouraging Open Conversations About Money

Open conversations about money create trust and normalize financial challenges. When a father openly discussed the family’s credit card debt and the steps to reduce it, his teenagers gained insight into financial realities beyond just saving and spending. Addressing mistakes openly helps kids see that financial setbacks happen, but resilience and learning from them are what matter. This approach fosters emotional maturity alongside financial literacy.

Resources to Enhance Kids’ Financial Literacy

Recommended Books and Games

Books like “The Berenstain Bears’ Trouble with Money” or games such as “Monopoly” offer practical, enjoyable ways to introduce money concepts. These resources provide stories and scenarios children can relate to, making lessons stick more effectively. Parents who read these books with their children or play games together often find opportunities to discuss budgeting and the consequences of financial choices in a relaxed setting.

Useful Online Tools and Apps for Families

Several apps cater specifically to families wanting to build financial skills. For instance, apps that allow parents to set savings goals, track chores, and manage allowances digitally can keep children engaged while providing oversight. Parents who live busy lives find these tools helpful for maintaining consistency and turning money management into a shared routine without added stress. Exploring local community offerings, such as free financial literacy classes at libraries, can also supplement at-home learning and provide broader perspectives.