Understanding the Root Causes of Financial Disputes in Marriage

Common Money Conflicts Among Couples

Financial disputes often originate from differing values and habits regarding money management. One spouse might prioritize saving for the future, while the other prefers spending to enjoy the present. These contrasting approaches can create tension and misunderstandings. Furthermore, issues such as hidden debts, unequal financial contributions, or disagreements about budgeting can deepen conflict. Recognizing these common triggers early helps couples address the underlying concerns rather than just the surface-level disagreements.

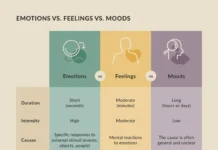

The Psychological Impact of Financial Stress

Financial stress extends beyond just monetary worries; it can deeply affect emotional well-being and the quality of the marital relationship. Anxiety about bills, debt, or financial insecurity often leads to feelings of frustration, helplessness, and even resentment between spouses. This emotional strain can reduce patience and empathy, making communication more challenging. By understanding the psychological toll money problems can have, couples are better equipped to approach financial disputes with sensitivity and care.

Preparation Before Addressing the Issue

Self-Reflection and Setting Personal Goals

Before initiating a conversation about finances, it is crucial for each spouse to engage in honest self-reflection. This means assessing one’s attitudes toward money and recognizing personal financial habits and fears. Understanding what money truly means beyond mere spending or saving helps clarify individual motivations. After this introspection, setting clear personal goals related to financial health or marital harmony establishes a positive mindset for productive discussions.

Gathering Financial Information Transparently

Transparency is the foundation for resolving financial disputes. Couples should gather relevant financial documents such as credit card statements, bank accounts, loans, and budgets in advance. Reviewing these together can reveal important insights, such as how money is being utilized and where power imbalances in financial control may exist. This preparation ensures that both partners have accurate information, reducing misunderstandings and building trust during conversations.

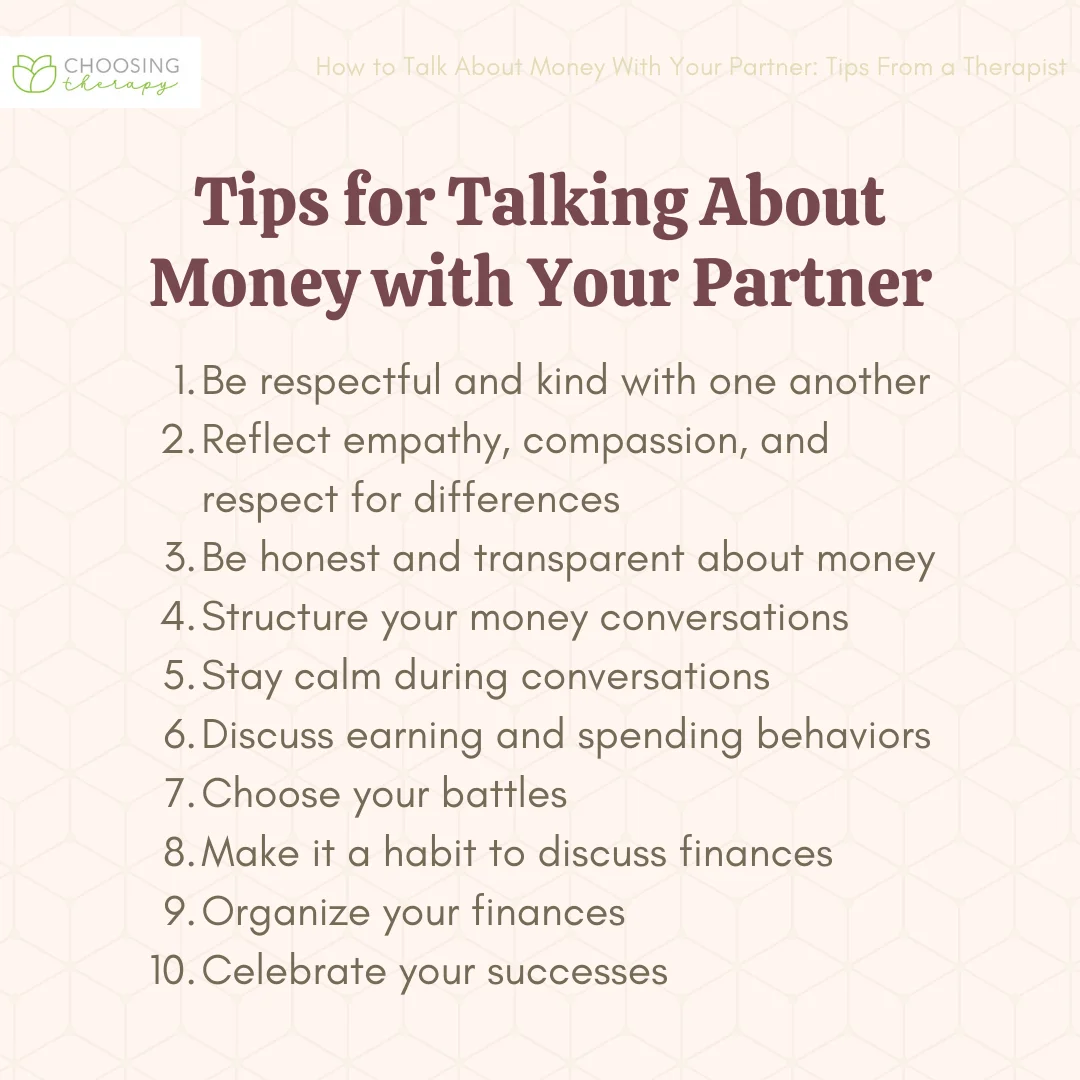

Techniques for Effective Communication About Money

Active Listening and Empathy in Financial Discussions

Effective communication starts with active listening. This means fully concentrating on what your spouse is saying without interrupting or formulating a rebuttal in your mind. Showing empathy by acknowledging their feelings validates their experience and creates a safer environment for open dialogue. When each partner feels heard and understood, it becomes easier to collaboratively solve money issues and foster teamwork rather than competition.

Using “I” Statements to Reduce Conflict

Expressing feelings using “I” statements instead of accusatory “you” phrases helps lower defensiveness. For example, saying “I feel worried when we don’t stick to our budget” focuses on personal emotions rather than blaming the other spouse. This subtle shift encourages connection, reduces hostility, and invites your partner to share their perspective without feeling attacked. Practicing this communication style consistently improves financial discussions over time.

Developing a Joint Financial Plan

Budgeting Together: Tools and Tips

Creating a budget collaboratively empowers couples to align their spending and saving habits. Using tools such as budgeting apps or spreadsheets can bring clarity and structure. Start by listing all income sources and essential expenses, then allocate amounts for discretionary spending that reflects shared priorities. Importantly, budgeting should be flexible to accommodate life changes and differing money styles, helping both spouses feel included and respected.

Setting Shared Financial Goals and Priorities

Beyond the numbers, developing joint goals like saving for a home, planning vacations, or preparing for retirement fosters a sense of unity. Discuss what goals are most important and establish timelines to achieve them. This collaboration encourages motivation and discipline. Recognizing how different money styles complement each other can turn financial planning into a way to strengthen your marriage, rather than just a tool to solve existing problems.

Resolving Disputes Through Mediation and Counseling

When to Seek Professional Help

If financial disagreements persist despite best efforts, or if hidden debts or secrets emerge, seeking professional mediation or counseling may be necessary. Professionals provide neutral ground to explore underlying issues and offer guidance on communication techniques and financial management. Early intervention can prevent disputes from escalating and support couples in rebuilding trust and cooperation.

What to Expect During Financial Counseling Sessions

During counseling, couples can expect a structured environment where both partners express concerns openly. Counselors may help identify patterns in conflict, facilitate shared goal setting, and provide education about money management. Sessions often include exploring emotional connections to money, allowing couples to confess struggles and needs openly. This process not only resolves immediate disputes but also equips couples with tools for ongoing financial fitness.

Maintaining a Healthy Financial Relationship

Regular Money Check-Ins

Consistently scheduling time to discuss finances helps maintain transparency and mutual accountability. These check-ins serve as opportunities to review budgets, celebrate progress, and adjust plans as needed. Regular discussions also prevent small issues from festering into larger conflicts and reinforce teamwork in managing money rather than letting money control the relationship.

Building Trust Through Transparency and Accountability

Trust is built when both spouses are open about their financial decisions and take responsibility for their commitments. Avoiding secrecy and sharing updates fosters a safe environment. Appreciating how each person’s unique approach to money contributes positively to the family encourages respect and patience. Remembering not to idolize money but to use it as a means to support shared life goals helps keep financial disputes in perspective.